Vacancy, rent growth likely to improve in 2025 as development slows

CoStar Analytics

January 15, 2025 | 3:26 P.M.

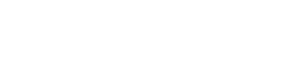

The multifamily market in Memphis, Tennessee, ended 2024 on a high note, with annual apartment demand outpacing supply for the first time since 2021. And with a slowing construction pipeline anticipated, rent growth and vacancy are expected to improve in 2025.

Increasing demand saw net absorption — the difference between move-in and move-outs — reach 1,700 units last year, an improvement from negative 800 in 2023 and the third-highest amount in the past 10 years.

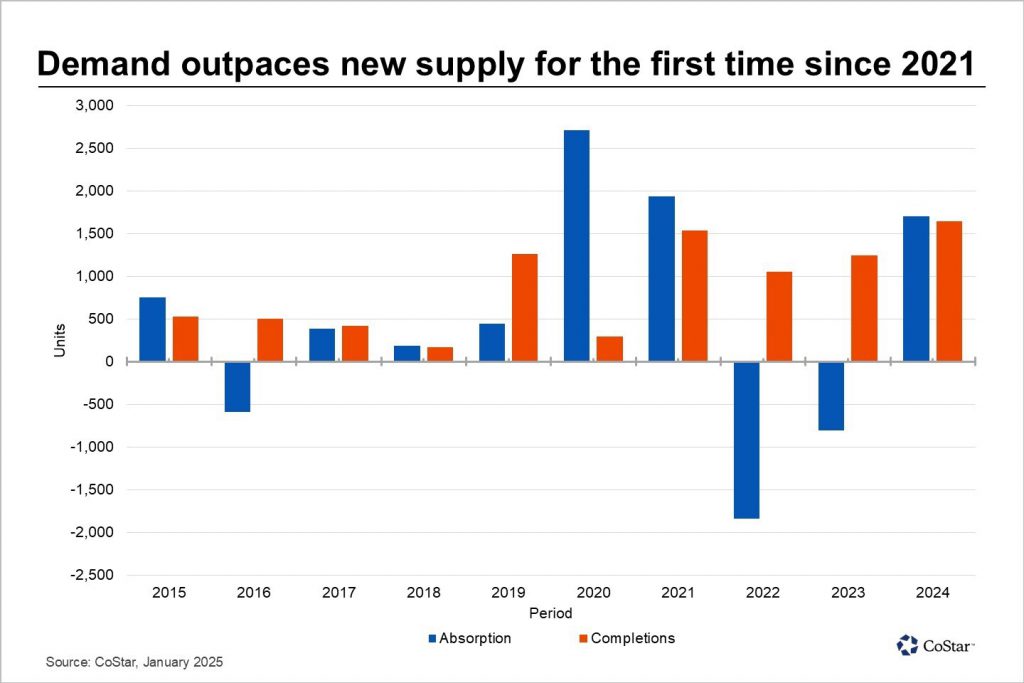

At the end of the year, the vacancy rate in Memphis was 13.6%, a 30-basis point improvement from the prior year, as commercial property segments saw vacancy decline across the board.

The multifamily market broke a two-year streak of declining demand, which saw its vacancy rate rise by 460 basis points from the beginning of 2022 through the end of 2023, peaking at 13.9%.

The largest increase in demand occurred among one- and two-star properties as consumer sentiment continued to rise and the pace of inflation slowed. These properties totaled just over 400 units of absorption in 2024, a large improvement from negative 700 units the previous year. This rise in demand pushed the vacancy rate among these properties down to 15.9%, a 140-basis point improvement from 2023’s year-end number.

Along with rising demand was a slowing development pipeline. High borrowing costs and tighter lending requirements limited the number of units under construction in Memphis at the end of 2024 to 1,400, a five-year low. As a result, 2025 is expected to see a decline in completions by about 25% from 2024’s level.

Despite improving demand, rent growth in Memphis continued to lag the national average. In 2024, rents increased 0.1%, the lowest level in the past 10 years, compared to 1% for the national average. The three-star property segment saw the most rent growth, at 1.5%, while the one-and-two-star segment and the four-and-five-star cohort posted annual declines.

With about 1,300 new apartments projected to open this year, slowing development will ease some of the supply-side pressures from the past two years. As a result, the apartment market’s vacancy rate will likely decline throughout the year as demand is expected to rise.