Does your management staff fully understand how small changes in expenses, occupancy, and delinquency can dramatically impact the value of your property?

Not only can it effect the value of your property, but it could affect the amount of loan you can get on the property.

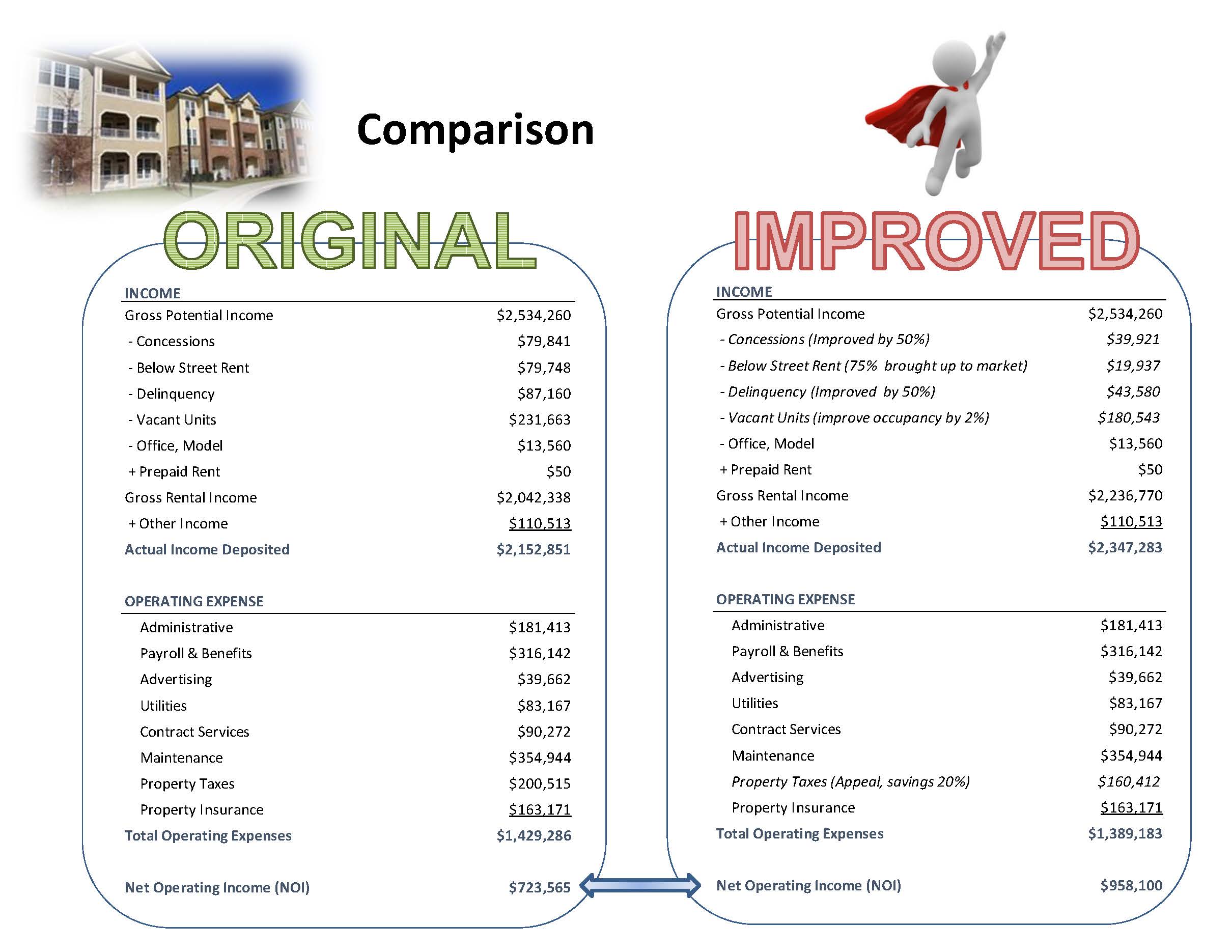

Quick example:

Let’s say your property brings in $2,534,260 in gross income and your total operating expenses are $1,429,286. This leaves what the apartment industry calls the Net Operating Income of $723,565.

The Net Operating Income is the number the appraiser uses to value your property when using the income approach to evaluation.

The appraiser will then apply the appropriate Capitalization Rate to that Net Operating Income to indicate the value of that particular property.

The capitalization rate is a fancy way of saying “the return the investors want to make on their money before debt” for that particular asset.

So, in the example above the NOI was $723,565 and the rate of return required by investors was 6.5%.

Then the value would be around $11,131,769.

Now lets say the management staff works hard and reduces expenses, improves collections, and the NOI goes up to $958,100. Now your property is worth $14,740,000!

Therefore, small changes can dramatically effect the Value.

Let us know if your staff would like a one hour or less presentation on this subject to help everyone understand the impact of small changes!

Have questions about YOUR property? Call us!